Note

This page was generated from tutorials/finance/08_fixed_income_pricing.ipynb.

Run interactively in the IBM Quantum lab.

Pricing Fixed-Income Assets¶

Introduction¶

We seek to price a fixed-income asset knowing the distributions describing the relevant interest rates. The cash flows \(c_t\) of the asset and the dates at which they occur are known. The total value \(V\) of the asset is thus the expectation value of:

Each cash flow is treated as a zero coupon bond with a corresponding interest rate \(r_t\) that depends on its maturity. The user must specify the distribution modeling the uncertainty in each \(r_t\) (possibly correlated) as well as the number of qubits he wishes to use to sample each distribution. In this example we expand the value of the asset to first order in the interest rates \(r_t\). This corresponds to studying the asset in terms of its duration. The approximation of the objective function follows the following paper: Quantum Risk Analysis. Woerner, Egger. 2018.

[1]:

import matplotlib.pyplot as plt

%matplotlib inline

import numpy as np

from qiskit import Aer, QuantumCircuit

from qiskit.aqua.algorithms import IterativeAmplitudeEstimation

from qiskit.circuit.library import NormalDistribution

[2]:

backend = Aer.get_backend('statevector_simulator')

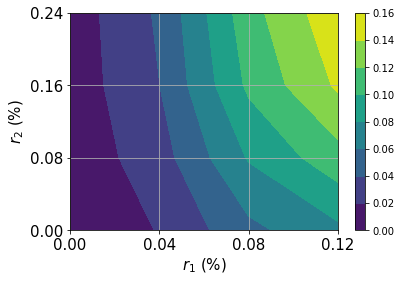

Uncertainty Model¶

We construct a circuit factory to load a multivariate normal random distribution in \(d\) dimensions into a quantum state. The distribution is truncated to a given box \(\otimes_{i=1}^d [low_i, high_i]\) and discretized using \(2^{n_i}\) grid points, where \(n_i\) denotes the number of qubits used for dimension \(i = 1,\ldots, d\). The unitary operator corresponding to the circuit factory implements the following:

where \(p_{i_1, ..., i_d}\) denote the probabilities corresponding to the truncated and discretized distribution and where \(i_j\) is mapped to the right interval \([low_j, high_j]\) using the affine map:

In addition to the uncertainty model, we can also apply an affine map, e.g. resulting from a principal component analysis. The interest rates used are then given by:

where \(\vec{x} \in \otimes_{i=1}^d [low_i, high_i]\) follows the given random distribution.

[3]:

# can be used in case a principal component analysis has been done to derive the uncertainty model, ignored in this example.

A = np.eye(2)

b = np.zeros(2)

# specify the number of qubits that are used to represent the different dimenions of the uncertainty model

num_qubits = [2, 2]

# specify the lower and upper bounds for the different dimension

low = [0, 0]

high = [0.12, 0.24]

mu = [0.12, 0.24]

sigma = 0.01*np.eye(2)

# construct corresponding distribution

bounds = list(zip(low, high))

u = NormalDistribution(num_qubits, mu, sigma, bounds)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/ipykernel_launcher.py:16: DeprecationWarning: `NormalDistribution` is deprecated as of version 0.17.0 and will be removed no earlier than 3 months after the release date. It moved to qiskit_finance.circuit.library.NormalDistribution.

app.launch_new_instance()

[4]:

# plot contour of probability density function

x = np.linspace(low[0], high[0], 2**num_qubits[0])

y = np.linspace(low[1], high[1], 2**num_qubits[1])

z = u.probabilities.reshape(2**num_qubits[0], 2**num_qubits[1])

plt.contourf(x, y, z)

plt.xticks(x, size=15)

plt.yticks(y, size=15)

plt.grid()

plt.xlabel('$r_1$ (%)', size=15)

plt.ylabel('$r_2$ (%)', size=15)

plt.colorbar()

plt.show()

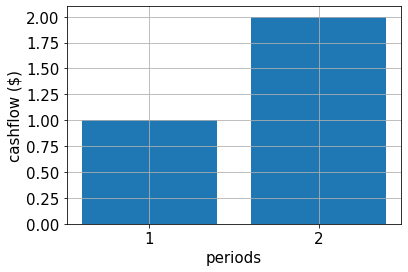

Cash flow, payoff function, and exact expected value¶

In the following we define the cash flow per period, the resulting payoff function and evaluate the exact expected value.

For the payoff function we first use a first order approximation and then apply the same approximation technique as for the linear part of the payoff function of the European Call Option.

[5]:

# specify cash flow

cf = [1.0, 2.0]

periods = range(1, len(cf) + 1)

# plot cash flow

plt.bar(periods, cf)

plt.xticks(periods, size=15)

plt.yticks(size=15)

plt.grid()

plt.xlabel('periods', size=15)

plt.ylabel('cashflow ($)', size=15)

plt.show()

[6]:

# estimate real value

cnt = 0

exact_value = 0.0

for x1 in np.linspace(low[0], high[0], pow(2, num_qubits[0])):

for x2 in np.linspace(low[1], high[1], pow(2, num_qubits[1])):

prob = u.probabilities[cnt]

for t in range(len(cf)):

# evaluate linear approximation of real value w.r.t. interest rates

exact_value += prob * (cf[t]/pow(1 + b[t], t+1) - (t+1)*cf[t]*np.dot(A[:, t], np.asarray([x1, x2]))/pow(1 + b[t], t+2))

cnt += 1

print('Exact value: \t%.4f' % exact_value)

Exact value: 2.1942

[7]:

# specify approximation factor

c_approx = 0.125

# get fixed income circuit appfactory

from qiskit.finance.applications import FixedIncomeExpectedValue

fixed_income = FixedIncomeExpectedValue(num_qubits, A, b, cf, c_approx, bounds)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/finance/__init__.py:50: DeprecationWarning: The package qiskit.finance is deprecated. It was moved/refactored to qiskit_finance (pip install qiskit-finance). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

warn_package('finance', 'qiskit_finance', 'qiskit-finance')

[8]:

fixed_income.draw()

[8]:

q_0: ───────────────────■──────────────────────────────────────────────────

│

q_1: ───────────────────┼─────────────■────────────────────────────────────

│ │

q_2: ───────────────────┼─────────────┼─────────────■──────────────────────

│ │ │

q_3: ───────────────────┼─────────────┼─────────────┼─────────────■────────

┌───────────┐┌─────┴──────┐┌─────┴──────┐┌─────┴─────┐┌──────┴───────┐

q_4: ┤ RY(9π/16) ├┤ RY(-π/216) ├┤ RY(-π/108) ├┤ RY(-π/27) ├┤ RY(-0.23271) ├

└───────────┘└────────────┘└────────────┘└───────────┘└──────────────┘[9]:

state_preparation = QuantumCircuit(fixed_income.num_qubits)

# load probability distribution

state_preparation.append(u, range(u.num_qubits))

# apply function

state_preparation.append(fixed_income, range(fixed_income.num_qubits))

state_preparation.draw()

[9]:

┌───────┐┌────┐

q_0: ┤0 ├┤0 ├

│ ││ │

q_1: ┤1 ├┤1 ├

│ P(X) ││ │

q_2: ┤2 ├┤2 F ├

│ ││ │

q_3: ┤3 ├┤3 ├

└───────┘│ │

q_4: ─────────┤4 ├

└────┘[10]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

# set objective qubit

objective = u.num_qubits

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(epsilon=epsilon, alpha=alpha,

state_preparation=state_preparation,

objective_qubits=[objective],

post_processing=fixed_income.post_processing)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/aqua/algorithms/amplitude_estimators/ae_algorithm.py:92: DeprecationWarning: The package qiskit.aqua.algorithms.amplitude_estimators is deprecated. It was moved/refactored to qiskit.algorithms.amplitude_estimators (pip install qiskit-terra). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

'qiskit.algorithms.amplitude_estimators', 'qiskit-terra')

[11]:

result = ae.run(quantum_instance=Aer.get_backend('qasm_simulator'), shots=100)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/aqua/quantum_instance.py:137: DeprecationWarning: The class qiskit.aqua.QuantumInstance is deprecated. It was moved/refactored to qiskit.utils.QuantumInstance (pip install qiskit-terra). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

'qiskit-terra')

[12]:

conf_int = np.array(result['confidence_interval'])

print('Exact value: \t%.4f' % exact_value)

print('Estimated value: \t%.4f' % (result['estimation']))

print('Confidence interval:\t[%.4f, %.4f]' % tuple(conf_int))

Exact value: 2.1942

Estimated value: 2.3134

Confidence interval: [2.2681, 2.3587]

[13]:

import qiskit.tools.jupyter

%qiskit_version_table

%qiskit_copyright

Version Information

| Qiskit Software | Version |

|---|---|

| Qiskit | 0.26.2 |

| Terra | 0.17.4 |

| Aer | 0.8.2 |

| Ignis | 0.6.0 |

| Aqua | 0.9.1 |

| IBM Q Provider | 0.13.1 |

| System information | |

| Python | 3.7.7 (default, Apr 22 2020, 19:15:10) [GCC 9.3.0] |

| OS | Linux |

| CPUs | 32 |

| Memory (Gb) | 125.71903228759766 |

| Tue May 25 17:24:31 2021 EDT | |

This code is a part of Qiskit

© Copyright IBM 2017, 2021.

This code is licensed under the Apache License, Version 2.0. You may

obtain a copy of this license in the LICENSE.txt file in the root directory

of this source tree or at http://www.apache.org/licenses/LICENSE-2.0.

Any modifications or derivative works of this code must retain this

copyright notice, and modified files need to carry a notice indicating

that they have been altered from the originals.

[ ]: