Note

This page was generated from tutorials/finance/10_qgan_option_pricing.ipynb.

Run interactively in the IBM Quantum lab.

Option Pricing with qGANs¶

Introduction¶

In this notebook, we discuss how a Quantum Machine Learning Algorithm, namely a quantum Generative Adversarial Network (qGAN), can facilitate the pricing of a European call option. More specifically, a qGAN can be trained such that a quantum circuit models the spot price of an asset underlying a European call option. The resulting model can then be integrated into a Quantum Amplitude Estimation based algorithm to evaluate the expected payoff - see European Call Option Pricing. For further details on learning and loading random distributions by training a qGAN please refer to Quantum Generative Adversarial Networks for Learning and Loading Random Distributions. Zoufal, Lucchi, Woerner. 2019.

[1]:

import matplotlib.pyplot as plt

import numpy as np

from qiskit import Aer, QuantumRegister, QuantumCircuit

from qiskit.circuit import ParameterVector

from qiskit.circuit.library import TwoLocal, NormalDistribution

from qiskit.quantum_info import Statevector

from qiskit.aqua import aqua_globals, QuantumInstance

from qiskit.aqua.algorithms import IterativeAmplitudeEstimation

from qiskit.finance.applications import EuropeanCallExpectedValue

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/finance/__init__.py:50: DeprecationWarning: The package qiskit.finance is deprecated. It was moved/refactored to qiskit_finance (pip install qiskit-finance). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

warn_package('finance', 'qiskit_finance', 'qiskit-finance')

Uncertainty Model¶

The Black-Scholes model assumes that the spot price at maturity \(S_T\) for a European call option is log-normally distributed. Thus, we can train a qGAN on samples from a log-normal distribution and use the result as an uncertainty model underlying the option. In the following, we construct a quantum circuit that loads the uncertainty model. The circuit output reads

where the probabilities \(p_{\theta}^{j}\), for \(j\in \left\{0, \ldots, {2^n-1} \right\}\), represent a model of the target distribution.

[2]:

# Set upper and lower data values

bounds = np.array([0.,7.])

# Set number of qubits used in the uncertainty model

num_qubits = 3

# Load the trained circuit parameters

g_params = [0.29399714, 0.38853322, 0.9557694, 0.07245791, 6.02626428, 0.13537225]

# Set an initial state for the generator circuit

init_dist = NormalDistribution(num_qubits, mu=1., sigma=1., bounds=bounds)

# construct the variational form

var_form = TwoLocal(num_qubits, 'ry', 'cz', entanglement='circular', reps=1)

# keep a list of the parameters so we can associate them to the list of numerical values

# (otherwise we need a dictionary)

theta = var_form.ordered_parameters

# compose the generator circuit, this is the circuit loading the uncertainty model

g_circuit = init_dist.compose(var_form)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/ipykernel_launcher.py:10: DeprecationWarning: `NormalDistribution` is deprecated as of version 0.17.0 and will be removed no earlier than 3 months after the release date. It moved to qiskit_finance.circuit.library.NormalDistribution.

# Remove the CWD from sys.path while we load stuff.

Evaluate Expected Payoff¶

Now, the trained uncertainty model can be used to evaluate the expectation value of the option’s payoff function with Quantum Amplitude Estimation.

[3]:

# set the strike price (should be within the low and the high value of the uncertainty)

strike_price = 2

# set the approximation scaling for the payoff function

c_approx = 0.25

# construct circuit for payoff function

european_call_objective = EuropeanCallExpectedValue(

num_qubits,

strike_price=strike_price,

rescaling_factor=c_approx,

bounds=bounds

)

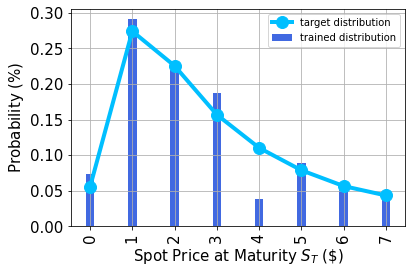

Plot the probability distribution¶

Next, we plot the trained probability distribution and, for reasons of comparison, also the target probability distribution.

[4]:

# Evaluate trained probability distribution

values = [bounds[0] + (bounds[1] - bounds[0]) * x / (2 ** num_qubits - 1) for x in range(2**num_qubits)]

uncertainty_model = g_circuit.assign_parameters(dict(zip(theta, g_params)))

amplitudes = Statevector.from_instruction(uncertainty_model).data

x = np.array(values)

y = np.abs(amplitudes) ** 2

# Sample from target probability distribution

N = 100000

log_normal = np.random.lognormal(mean=1, sigma=1, size=N)

log_normal = np.round(log_normal)

log_normal = log_normal[log_normal <= 7]

log_normal_samples = []

for i in range(8):

log_normal_samples += [np.sum(log_normal==i)]

log_normal_samples = np.array(log_normal_samples / sum(log_normal_samples))

# Plot distributions

plt.bar(x, y, width=0.2, label='trained distribution', color='royalblue')

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.grid()

plt.xlabel('Spot Price at Maturity $S_T$ (\$)', size=15)

plt.ylabel('Probability ($\%$)', size=15)

plt.plot(log_normal_samples,'-o', color ='deepskyblue', label='target distribution', linewidth=4, markersize=12)

plt.legend(loc='best')

plt.show()

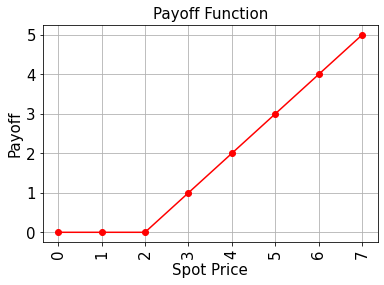

Evaluate Expected Payoff¶

Now, the trained uncertainty model can be used to evaluate the expectation value of the option’s payoff function analytically and with Quantum Amplitude Estimation.

[5]:

# Evaluate payoff for different distributions

payoff = np.array([0,0,0,1,2,3,4,5])

ep = np.dot(log_normal_samples, payoff)

print("Analytically calculated expected payoff w.r.t. the target distribution: %.4f" % ep)

ep_trained = np.dot(y, payoff)

print("Analytically calculated expected payoff w.r.t. the trained distribution: %.4f" % ep_trained)

# Plot exact payoff function (evaluated on the grid of the trained uncertainty model)

x = np.array(values)

y_strike = np.maximum(0, x - strike_price)

plt.plot(x, y_strike, 'ro-')

plt.grid()

plt.title('Payoff Function', size=15)

plt.xlabel('Spot Price', size=15)

plt.ylabel('Payoff', size=15)

plt.xticks(x, size=15, rotation=90)

plt.yticks(size=15)

plt.show()

Analytically calculated expected payoff w.r.t. the target distribution: 1.0547

Analytically calculated expected payoff w.r.t. the trained distribution: 0.9805

[6]:

# construct A operator for QAE

european_call = european_call_objective.compose(uncertainty_model, front=True)

[7]:

# set target precision and confidence level

epsilon = 0.01

alpha = 0.05

# construct amplitude estimation

ae = IterativeAmplitudeEstimation(epsilon=epsilon, alpha=alpha,

state_preparation=european_call,

objective_qubits=[num_qubits],

post_processing=european_call_objective.post_processing)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/aqua/algorithms/amplitude_estimators/ae_algorithm.py:92: DeprecationWarning: The package qiskit.aqua.algorithms.amplitude_estimators is deprecated. It was moved/refactored to qiskit.algorithms.amplitude_estimators (pip install qiskit-terra). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

'qiskit.algorithms.amplitude_estimators', 'qiskit-terra')

[8]:

result = ae.run(quantum_instance=Aer.get_backend('qasm_simulator'), shots=100)

/home/computertreker/git/qiskit/qiskit-dup/.tox/docs/lib/python3.7/site-packages/qiskit/aqua/quantum_instance.py:137: DeprecationWarning: The class qiskit.aqua.QuantumInstance is deprecated. It was moved/refactored to qiskit.utils.QuantumInstance (pip install qiskit-terra). For more information see <https://github.com/Qiskit/qiskit-aqua/blob/master/README.md#migration-guide>

'qiskit-terra')

[9]:

conf_int = np.array(result['confidence_interval'])

print('Exact value: \t%.4f' % ep_trained)

print('Estimated value: \t%.4f' % (result['estimation']))

print('Confidence interval:\t[%.4f, %.4f]' % tuple(conf_int))

Exact value: 0.9805

Estimated value: 1.0138

Confidence interval: [0.9883, 1.0394]

[10]:

import qiskit.tools.jupyter

%qiskit_version_table

%qiskit_copyright

Version Information

| Qiskit Software | Version |

|---|---|

| Qiskit | 0.25.4 |

| Terra | 0.17.2 |

| Aer | 0.8.2 |

| Ignis | 0.6.0 |

| Aqua | 0.9.1 |

| IBM Q Provider | 0.12.3 |

| System information | |

| Python | 3.7.7 (default, Apr 22 2020, 19:15:10) [GCC 9.3.0] |

| OS | Linux |

| CPUs | 32 |

| Memory (Gb) | 125.71903228759766 |

| Tue May 25 16:25:45 2021 EDT | |

This code is a part of Qiskit

© Copyright IBM 2017, 2021.

This code is licensed under the Apache License, Version 2.0. You may

obtain a copy of this license in the LICENSE.txt file in the root directory

of this source tree or at http://www.apache.org/licenses/LICENSE-2.0.

Any modifications or derivative works of this code must retain this

copyright notice, and modified files need to carry a notice indicating

that they have been altered from the originals.